In an economic crisis of any kind - and the world is certainly facing one now in the midst of the COVID 19 crisis - saving money seems like the natural thing to do. Often, as is currently the case, the stock markets are too volatile for the average individual investor's comfort and uncertain markets means that other traditional investment routes seem riskier than usual too.

The next logical step for many would seem to be putting money into a savings account. But as interest rates fall, which almost always happens in harder economic times, any profit made there is meager at best.

A more sensible move? Invest any available capital in assets that are more reliable, and unaffected by the ups and downs of the stock market. And fine diamonds are one such asset.

While, when it is brought up, the idea of investing in fine diamonds does make sense to many they face another hurdle; how do you get started in diamond investment and ensure you are making the right choices? Here are some basic pointers to keep in mind.

Understand That Diamonds Are Best As a Long Term Investment

When buying diamonds you are rarely looking at something that can be flipped quickly' for a huge profit. Instead, they are a long term investment, an addition to that emergency financial plan that you keep hearing that you need. And there is a risk in investing in diamonds - their value may decrease - but that is far less likely than a stock that is subject to daily fluctuations.

Understand the Importance of Diamond Investment Education

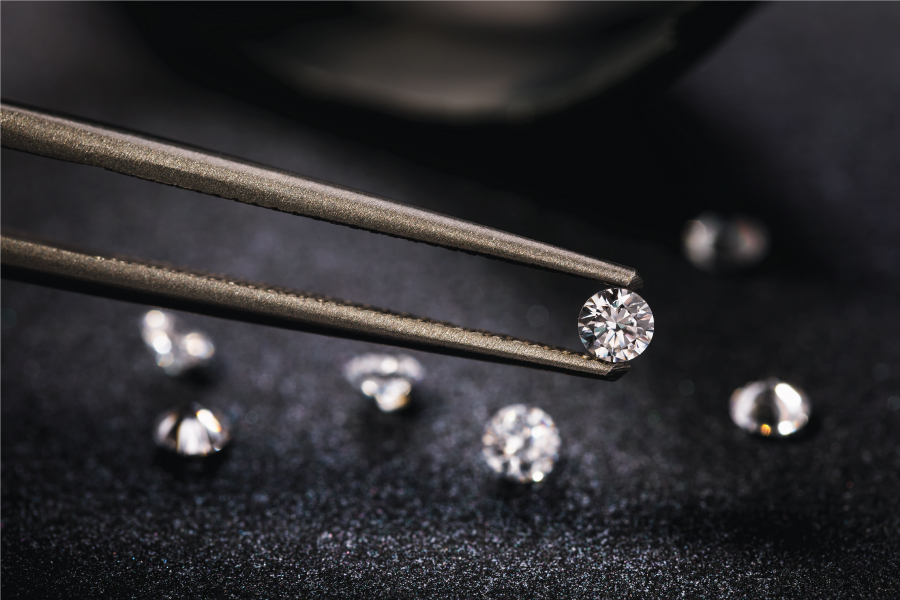

To the untrained eye all diamonds are beautiful. They are sparkly and glamorous and, put simply, quite stunning. But when looked at from a diamond investment point of view, rather than simply an aesthetic one, diamonds are quite different from one another.

Determining which diamonds might make the best investments calls for education and experience. As well as a 'good nose' for quality, as that is another aspect in which diamonds are certainly not created equally at all. A 'pretty' diamond may not always be quite what it seems...

This knowledge all takes time to gain. Decades to be precise. Time you probably don't have. That's why working with a trusted diamond expert is a must. But not just anyone, one who's willing to share insights into why a certain gem is such a good buy, as the experts at Assteria Diamonds do. Not only do they know diamonds themselves intimately, but they also understand what to look for in a diamond as an investment.

Understand the Importance of Investment Diversification

Putting all your money into any one investment is rarely a good idea, and for most individual investors a diverse portfolio is a must, even in a difficult economy. In addition to meeting with a diamond expert - which can be done virtually by the way - anyone investing in diamonds should consult a personal financial advisor about the best ways to incorporate diamond investment into their current asset portfolio.

Understand the Importance of Diamond Diversification

If you are going to invest in diamonds it is rarely wise to stake all your hopes on just a single diamond. A traditional stock portfolio is made up of a number of options, and a great diamond investment portfolio should be the same.

Buy From the Right Places

Buying a diamond, especially one for investment purposes, can be a risky thing. If you are not trained in gem evaluations - which it's doubtful you are - every diamond can look very similar - again, shiny, sparkly and beautiful - but their weight, clarity, cut and in some cases color affects their value significantly.

To ensure that you are getting a good deal work with a diamond broker you can trust. At Astteria Diamonds our team has the experience - and the reputation - you need to make the diamond investments that are best suited to your unique needs.